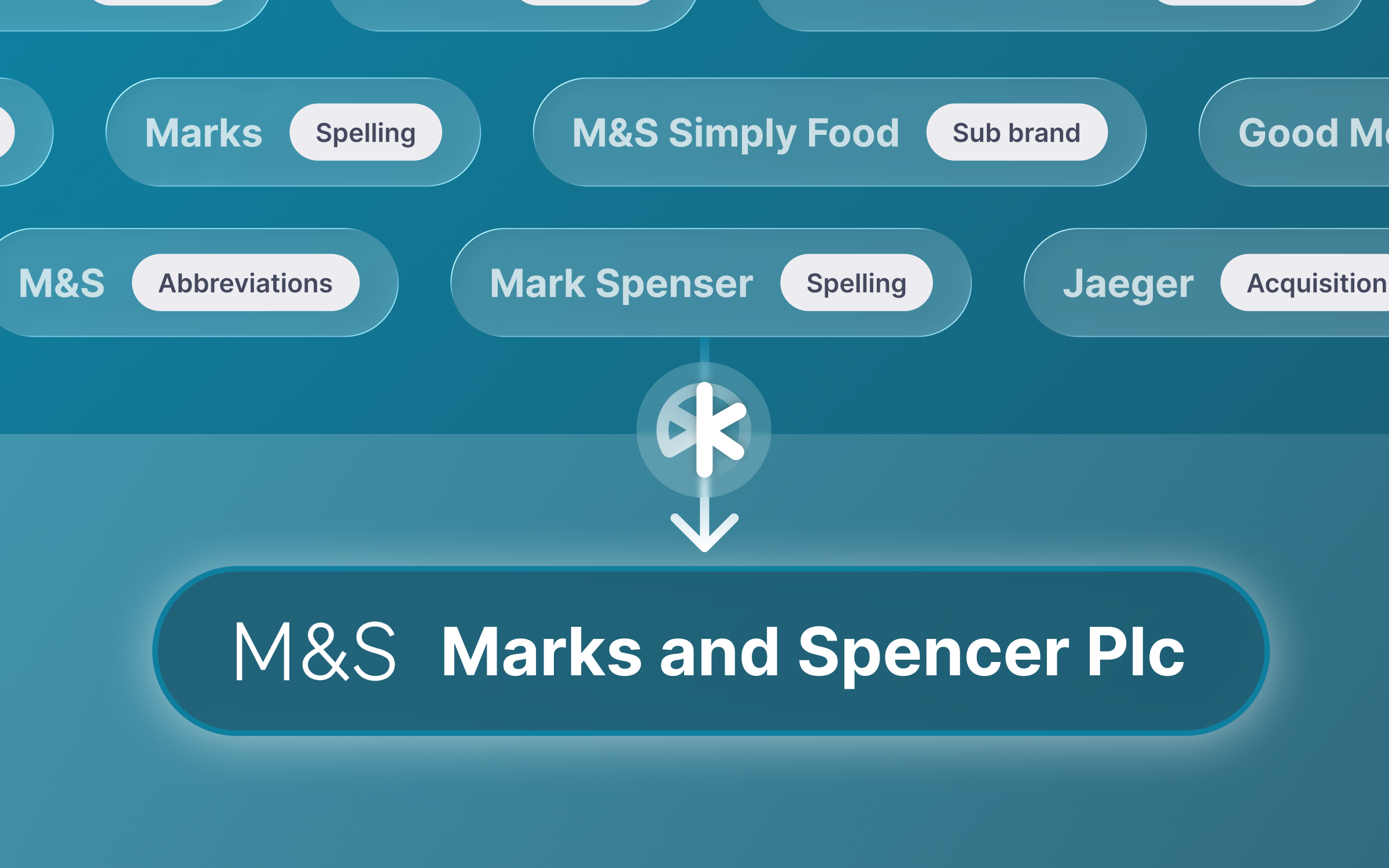

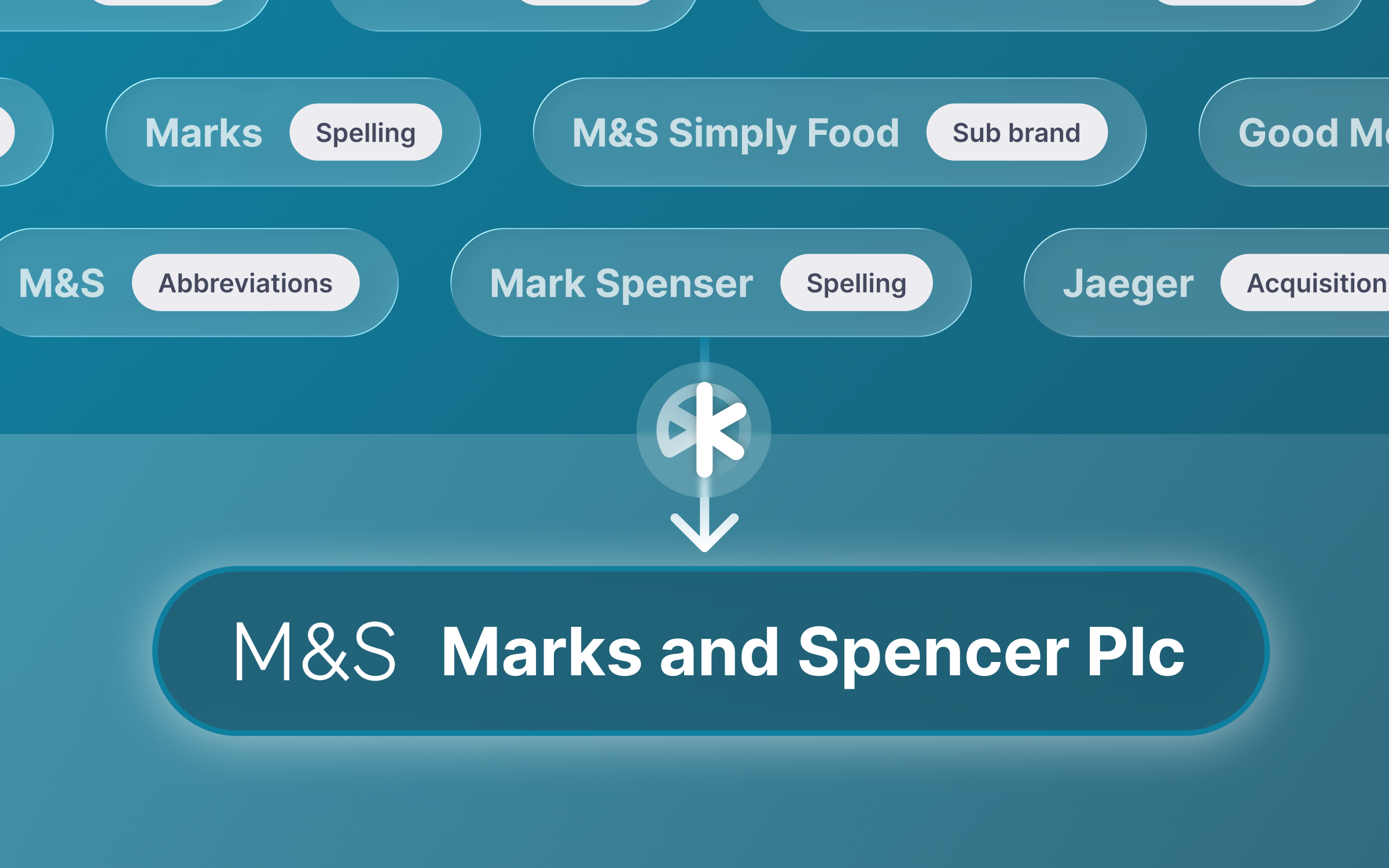

Employment verification is strong when employer names match. At its core, each check depends on matching what an applicant declares with what can be found in trusted, authoritative records. If someone says they worked at "M&S," the system has to know this aligns with "Marks and Spencer Plc." Without that match, even genuine employments risk being marked as unverifiable.

It sounds simple, but in practice Employer Matching is one of the trickiest challenges in the entire verification process. Names are inconsistent, data is messy, and applicants often provide incomplete or slightly inaccurate details. Add in mergers, acquisitions and rebrands, and what should be a clear picture of a person’s employment history quickly becomes blurred.

There are many reasons Employer Matching is difficult:

1. Inconsistent Naming

Applicants rarely enter names in a standardised way. Abbreviations, typos, or colloquial names are common. For example, "PwC," "Price Waterhouse Cooper," and "PricewaterhouseCoopers LLP" all describe the same organisation but look completely different on paper.

2. Rebrands, Mergers and Subsidiaries

Companies evolve constantly. When Thomas Cook Group became part of Fosun Tourism Group, or when Facebook became Meta, historical records shifted. Without a reliable way to recognise these relationships, matches break down.

3. Overlapping or Conflicting Dates

Even when names are correct, dates can trip up a system. An applicant might round their employment dates to the nearest month, while HMRC or payroll records show precise start and end days. What should be a match ends up as a discrepancy.

4. User-Submitted Inaccuracies

Sometimes applicants make simple mistakes - a misspelling, an incomplete job title, or forgetting to include a short-term role. These errors can cause otherwise valid employment to appear unverifiable.

5. Multiple Data Sources

Employment history often comes from more than one source: Open Banking, Payroll, HMRC, and even uploaded documentation. Each source has its own quirks. Without a way to stitch them together, the result can be duplication, noise, or gaps.

Verification relies on stitching together declared employment with verified records. If the link is not made, the check will fail. This doesn't just create frustration for applicants, it creates friction for employers, screeners and recruiters who then have to manually review information.

Poor Employer Matching has several knock-on effects:

When speed and accuracy are both critical and time sensitive, these issues add up quickly. A single misaligned employer record can slow down the entire process, undermining both the applicant experience, operational efficiency, and even result in applicants dropping out completely.

At first glance, building an internal Employer Matching system might look plausible: combine rules for string matching, maintain a list of known aliases, and patch gaps as they arise. But in reality, it's a moving target that requires constant optimisation.

Alias libraries need updating every time a company rebrands or a new variant appears. “Fuzzy” matching rules are complex to tune and produce false positives. And reconciling dates, roles, and industry context requires more than simple string logic.

Without continuous refinement, the system drifts out of sync with real-world employer data. That means verification success rates fall, manual intervention rises, and the burden on internal teams only grows.

Employer matching needs more than patchwork fixes. It requires systems that can recognise aliases, constantly adapt to change, and explain the logic behind a match. This is the only way to ensure checks succeed reliably, keep conversion rates high and reduce reliance on manual review.

.png)

Konfir has developed Klarity to address these challenges as part of the Verification Waterfall. By resolving ambiguity between declared and verified employments, Klarity ensures more applicants complete the journey, outcomes are clearer, and teams can focus on decisions rather than untangling data.